As costs mount in the busiest period of the year, the latest data from the TEG Road Transport Price Index has shown a jump in road freight prices in November. This marks the first November since 2019 to experience an increase, however, prices remain lower than November prices in the previous two years. With pressure on the haulage sector following a record year of UK haulier insolvencies, industry players will be hopeful for a year of less volatile costs heading into 2024, with unpredictable fuel prices creating an uncertain forecast.

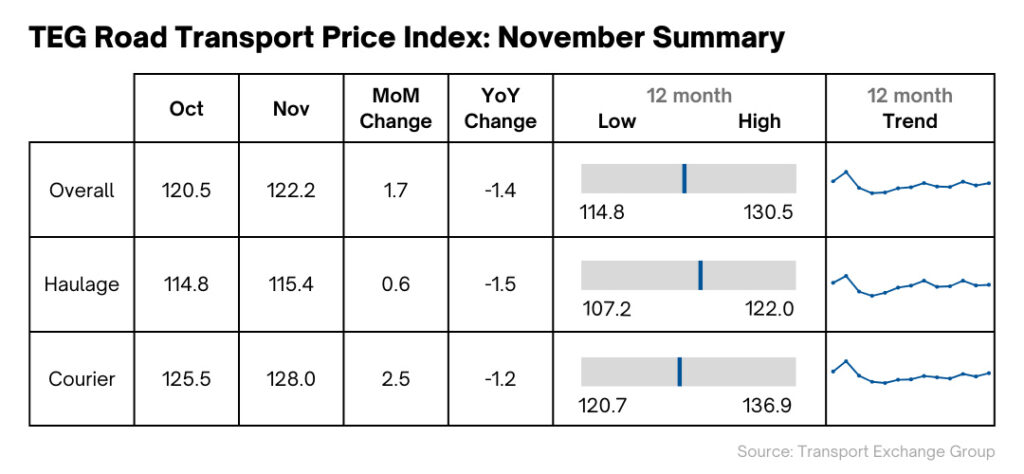

November figures show a rise in the overall price per mile for haulage and courier vehicles, increasing by 1.4% from 120.5 to 122.2. This rise was largely due to a notable jump in courier prices, increasing 125.5 to 128 points (2.0%). Haulage prices also increased slightly, rising 0.6 points from 114.8 to 115.4 during November, just 0.5%.

Despite the price of road freight services rising, fuel prices have dropped in the height of peak season, which will come as welcome news to operators reigning in expenditure during the most expensive period of the year. Following recent legislation forcing fuel retailers to display fuel prices online, current petrol prices are at £151.02 (-2.65% change), with diesel prices at £158.97 (-1.98% change). With motorists able to shop around, the initiative looks to be a success with prices down an average of 20.79% from last year.

463 UK haulage firms fold in the last year

The last year has proved exceptionally challenging for many UK hauliers. Data collated by accountancy firm Price Bailey has shed light on the pressures faced by UK haulage businesses, with twice as many going bust in the last 12 months as two years ago.

The industry has been struggling due to a number of factors constraining profits, including soaring overheads and interest rate hikes which have made servicing debt increasingly expensive.

The data report noted particular risk for London-based haulage businesses, with 41% currently classified as maximum risk versus 26% this time last year. This trend will undoubtedly spread across the UK, with pressures mounting as a result of untenable operational costs.

Autumn Statement reflections – Chancellor falls short of tangible support for haulage

The recent Autumn Statement was largely underwhelming for the industry, with announcements lacking in notable provision for UK hauliers requiring support for the year ahead.

The announcements did include a pledge of £2bn dedicated to supporting the manufacturing and development of zero-emission vehicles, which will be a great help in supporting net-zero efforts. However, the Chancellor made no mention of cancelling the planned increase in fuel duty next April, or plans to tackle the UK’s pothole problem, despite £8.3 billion being pledged.

Lyall Cresswell, CEO of Transport Exchange Group, says:

“We’ve seen rising prices over the last month, when typically prices experience a dip at this point in the pre-Christmas busy season. It will be interesting to see if this head start in prices rising pushes December prices up even further. Fortunately, fuel prices are continuing to drop and road freight prices remain lower than last year, so we are entering 2024 with cautious optimism.

“As we look towards next year, we’re hopeful that government promises to the haulage sector will be upheld and that we will see notable progress in the proposed initiatives to accelerate net-zero efforts.

“While the recent Autumn Statement was lacking in significant support for the industry, we are confident that the new year will bring many exciting opportunities, and that 2024 will be a better year for the road freight industry.”

Kirsten Tisdale, Director of Logistics Consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport, says:

“Despite volumes being (a very believable) 10% down this year according to Richard Smith, Managing Director of the RHA, and diesel being deflationary compared to a year ago, the TEG haulage price index rose very slightly, narrowing the gap on last year’s figure.

“The courier index was more buoyant, nearly closing the recent gap against last year, which may have something to do with the timing of Black Friday.”