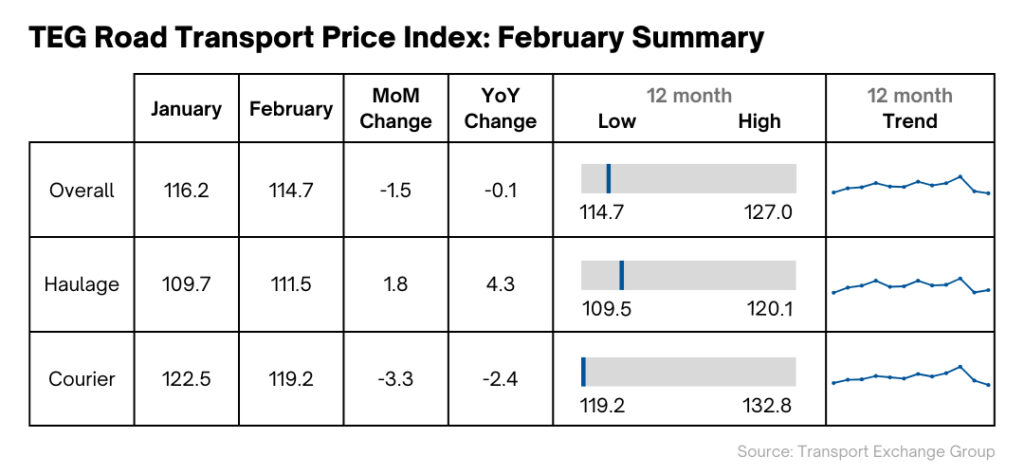

Data on road transport prices released this month have revealed a second consecutive month of lowered rates. The overall price-per-mile for haulage and courier vehicles dropped from 116.2 to 114.7 during February, following previous years’ trends. This was largely due to a significant drop in courier prices, which have reached their lowest point since April 2022.

The latest insights from the TEG Road Transport Price Index align with post-peak season patterns, with road freight operators dropping prices after the busiest point in the year. With less demand, many operators have dropped prices to entice more work in the post-Christmas dip.

Meanwhile, the report shows a surprising trend in haulage prices which have increased by 1.8 points, rising to 111.5. This marks the first time haulage prices have risen in February since the index first started recording in 2019.

The latest increases in fuel prices are yet to affect road transport prices. Despite the slight increase, petrol remains 3.9% lower and diesel remains 10.8% lower than February 2023.

Nonetheless, the latest budget has brought welcome news that the temporary 5p reduction on Fuel Duty will be extended until March 2025, providing operators with some temporary relief and reducing uncertainty for the next year.

Half a million driver qualification cards (DQCs) set to expire in 2024

The industry is still seeing surprising effects of the pandemic. Beyond the driver shortage and liquidations, more unexpected consequences are surfacing.

Road freight operators may be expecting driver shortages in the coming year, with nearly half a million driver qualification cards (DQCs) due to expire this year. The Covid-19 pandemic restricted opportunities for drivers to undertake CPC courses in 2020 and 2021, which caused more individuals lacking refresher training in the past five years than in previous periods.

With driver numbers still low post-pandemic, it’s vital that driver CPCs are renewed to ensure shortages are not exacerbated, with driver numbers already at critical levels.

AI aids government crackdown on road traffic offences

After recent trials in AI-enhanced technology to spot road traffic offences, drivers should be wary as penalty points and fines are threatened for offenders.

HGV and courier drivers with points on their licence will be particularly careful, with 10 police forces across the UK now implementing the technology. Detectable offences include failing to wear a seatbelt and using a mobile phone while driving, with camera footage passed onto police to assess the severity of the offence in a two stage process.

Lyall Cresswell, CEO of Transport Exchange Group, says:

“The road freight sector has started 2024 following price trends as expected. In the post-peak season period, overall prices have continued to fall despite rising fuel prices.

“However, the increases in haulage prices last month were particularly interesting, standing out from previous years’ overall price trends. These increases may be a reaction to more haulier administrations in the last few months, with SMEs looking to maximise profits.

“Looking to the year ahead, we can expect to see road transport prices start to rise going forward.

“The industry will also have one eye on the recent fuel increases. While rises have been slight so far, we’ll undoubtedly start to see petrol and diesel creeping up after this period of low rates.”

Kirsten Tisdale, Director of Logistics Consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport, says:

“Green shoots or Red Sea response? While the TEG index for courier work did what we all expected for February and went down a little, the TEG index for haulage made a surprising increase – after 20 months in deflation!

“News from the ONS about January retail sales was that they had done a surprising upswing after a dismal December. This could be the first sign of green shoots. But the rise in the TEG haulage index in the following month could also reflect the need for urgent replenishment following a combination of surprise sales and slower arrival of new stock.”