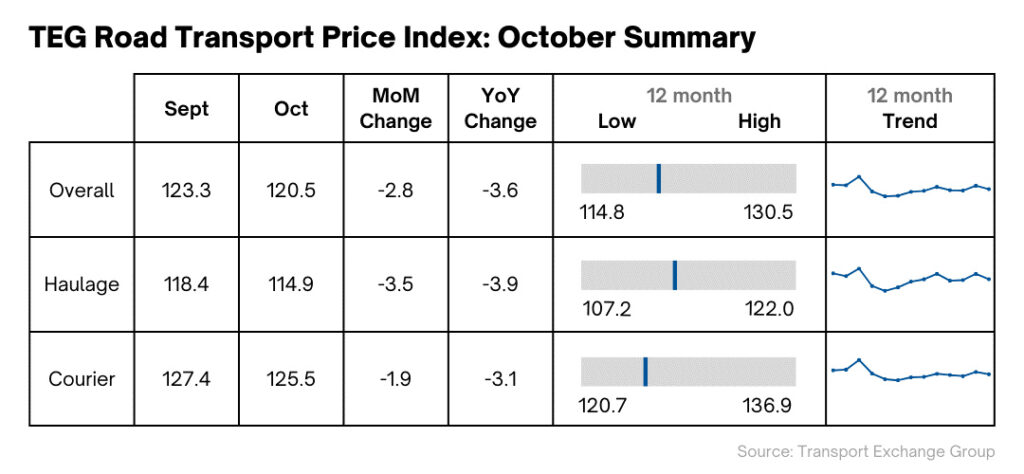

September saw the greatest monthly rise in road freight prices of 2023. However, October data from the TEG Road Transport Price Index shows a turn of events just before the industry enters the peak season, when freight prices historically reach their annual high. The overall price-per-mile for haulage and courier vehicles dropped by 2.8 points (-2.3%) from 123.3 to 120.5, denoting the largest fall in overall prices since February 2023. With business ramping up as we head towards Christmas, this should provide some relief in the most costly period of the year.

Haulage prices saw the most significant drop, dropping from 118.4 to 114.9 (-3.0%), while courier prices fell from 123.4 to 125.5. Prices are also down almost 4% compared to this time last year. This is partially due to a significant drop in diesel prices year-on-year: diesel prices have fallen by 22p per litre since October 2022.

This will be welcome news for operators, with previous concerns over rising fuel prices in the third quarter of this year. Fuel prices have since stabilised, a positive heading into the sector’s peak season.

Nonetheless, while October provided respite from more volatile periods prior, industry leaders are unsatisfied with a lack of assurance from the government over initiatives to help meet net-zero targets, leaving them without answers on how to best plan for the future. With the government procrastinating its net-zero efforts, the haulage sector is at the mercy of a volatile economy and fuel price hikes. With realistic predictions offering a pessimistic net-zero date, small victories will be crucial in ensuring progress is made.

With heavy costs expected for operators looking to adopt greener practices, this Autumn budget may be significant for satisfying industry concerns over what the future holds for the haulage sector.

Previous UK investment casts pessimistic forecast on budget

While recent announcements of investment in green transport projects should bode well for the transport industry’s budget outcome, previous years have seen transport severely neglected where investment was needed.

2022’s budget saw cuts to transport, with the UK struggling to stabilise as it emerged from the COVID pandemic. With health and education prioritised, it was a familiar story as the Department for Transport was shortchanged. 2021 saw the majority of investment dedicated to urban public transport, with little to prop up a struggling haulage sector. So with separate government investments already being announced, the prospect of the haulage industry featuring prominently in the Autumn budget may be a slim one.

With fuel duty rising and a less pressing focus on improving e-vehicle infrastructure, drivers are caught in a transitional period where there is little incentive to switch to green energy sources and yet are stuck paying ever-increasing prices on petrol and diesel.

The RHA has outlined how this Autumn statement can best support the transport industry. The trading association has suggested a fiscal incentive of an emissions-linked rebate to promote a switch to greener fuels. Alongside this, they state the need for a clear and comprehensive roadmap for commercial vehicle decarbonisation, which would support investments in infrastructure and technology.

There are also industry calls to review Clean Air Zones (CAZs) and their effectiveness versus the impact on businesses, and to halt increases to fuel duty on diesel for two years, to bring some much-needed stability to fuel prices. With the Chancellor under pressure to raise fuel duty (last raised in 2011), the odds of the haulage sector emerging unscathed are slim.

Lyall Cresswell, CEO of Transport Exchange Group, says:

“It’s a troubling time in the industry, and with a seeming lack of compromise from the government, a net-zero future where everyone is accounted for is looking increasingly unlikely.

“As industry leaders, we can only work with what’s in front of us. We make it our priority to future-proof our processes and make green changes where possible, but without government cooperation, the extent of our impacts will be limited.

“This Autumn budget will be crucial for us, and with the right investment and direction from the government, we are confident we will be able to move forward towards a green and sustainable future with assurance.”

Kirsten Tisdale, Director of Logistics Consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport, says:

“The Office for National Statistics released the Q3 figures for ‘freight transport services by road’ as part of the wider Services Producer Price Index and confirmed what those in the industry already knew, that road freight has been experiencing year-on-year deflation.

“The TEG index for October, more specific and more up-to-date, tells us that spot rates for haulage have now been deflationary for nearly a year and a half.

“Looking to the shipping industry to get some idea of where things might be going is not particularly cheering, with container rates currently very low. In this instance, it is due, at least in large part, to considerable over-capacity in that market.”