As 2023 drew to a close, road freight prices reached their highest point since December 2022, as anticipated by the industry. With fuel prices rising steadily between July and November last year and capacities strained amid peak season, costs continued to increase throughout the final quarter.

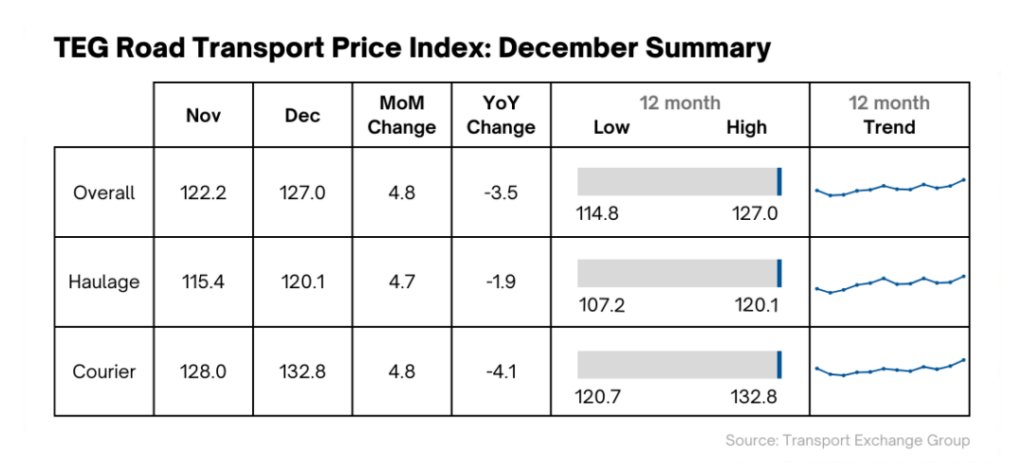

The latest data from the TEG Road Transport Price Index shows a rise in the price per mile for haulage and courier vehicles, increasing by 3.9% in December.

Courier prices rose by 3.8% from 128 to 132.8, while haulage rose by 4.07% from 115.4 to 120.1. Year-on-year, overall prices are still down 2.7% from the same period, with haulage and courier prices down 1.6% and 3.0% respectively.

Fortunately for businesses and consumers, this price hike in the supply chain is expected to be short-lived with prices already dropping in the first week of January.

While prices are expected to continue to lower throughout the month, the year ahead presents a significant degree of uncertainty, with most operators facing huge expenditure in making steps towards net-zero.

Fuel prices reached lowest monthly average since October 2021

Wholesale fuel prices saw significant reductions in the lead up to Christmas, resulting in the lowest average petrol price since October 2021, when average prices hit 138.64p. Meanwhile, diesel reached its lowest average price since July 2023, at 154.69p. Overall fuel prices have experienced the largest drop since August 2022, which followed an all-time peak in July of the same year.

With lower fuel prices, operators will be able to entice new business by lowering prices or capitalise on higher profit margins, starting 2024 on a positive footing.

However, the recent Red Sea attacks have created cause for concern, with fears that fuel prices will rise should shortages emerge amid disrupted supply chains. Nonetheless, commentators have suggested that oil market disruptions are unlikely to be overly impactful, as other sources of supply are keeping up with demand. Road freight operators will be optimistic that fuel prices will continue to fall, however such relief might be short-lived if the crisis escalates.

2024 set to be critical juncture in net-zero progress

With the government’s zero emission mandate coming into effect, the new legislation will require 70% of new vans sold to be zero emission by 2030, increasing to 100% by 2035, while 2040 remains as the target for banning the sale of non-zero emissions HGVs.

With many leading industry players making significant progress in green technology trials in the last year, the achievability of reaching net-zero targets will depend on the accessibility and affordability of such technology across the industry.

Nestlé and DAF both made strides in 2023 in trialling battery electric trucks, with largely positive results. However, such technologies will be unattainable for many smaller operators while transitioning costs remain high, and government subsidy will be required.

Subsequent road freight prices will undoubtedly factor in such costs, so we can expect to see additional increases across the year as businesses look to cover raised overheads.

Lyall Cresswell, CEO of Transport Exchange Group, says:

“With December being the month with the highest average road freight prices for the last three years, it comes as no surprise that last month continued that trend. Fortunately, our continued tracking of prices has allowed for a confident prediction that prices will lower throughout January.

“Unfortunately, however, this is due to a significant drop in sales, with January largely a month for tightening purse strings after an expensive peak month.

“As for the year ahead, we are unfortunately preparing to see more insolvencies across the industry if retail volumes don’t increase. While this may leave many hauliers out of work, we hope that drivers will be able to find new opportunities with the support of the industry.

“Despite a lot of uncertainty at the moment around the repercussions of the recent Red Sea attacks, it’s fantastic to see a sustained drop in fuel prices after several months of increases. It will be interesting to see whether the new powers granted to the Competition and Markets Authority (CMA) will bring any long term change, but more regulation will be most welcome.”

Kirsten Tisdale, Director of Logistics Consultants Aricia Limited and Fellow of the Chartered Institute of Logistics & Transport, says:

“There weren’t any Christmas surprises for the TEG Road Transport Price Indices – both haulage and courier spot rates were up on the month and down on the year for December.

“It’s still too early for full Christmas retail sales figures, but it’s fair to say that retail volumes generally are likely to remain depressed until the Bank Of England decides to relax interest rates. So, as we go into 2024, even more than in most years, now is the time to keep a really close eye on customer credit and cashflow.”